Ukrainian Tax Cabinet Integration Platform — Automated Tax Reporting & Government Data Sync

Client Request

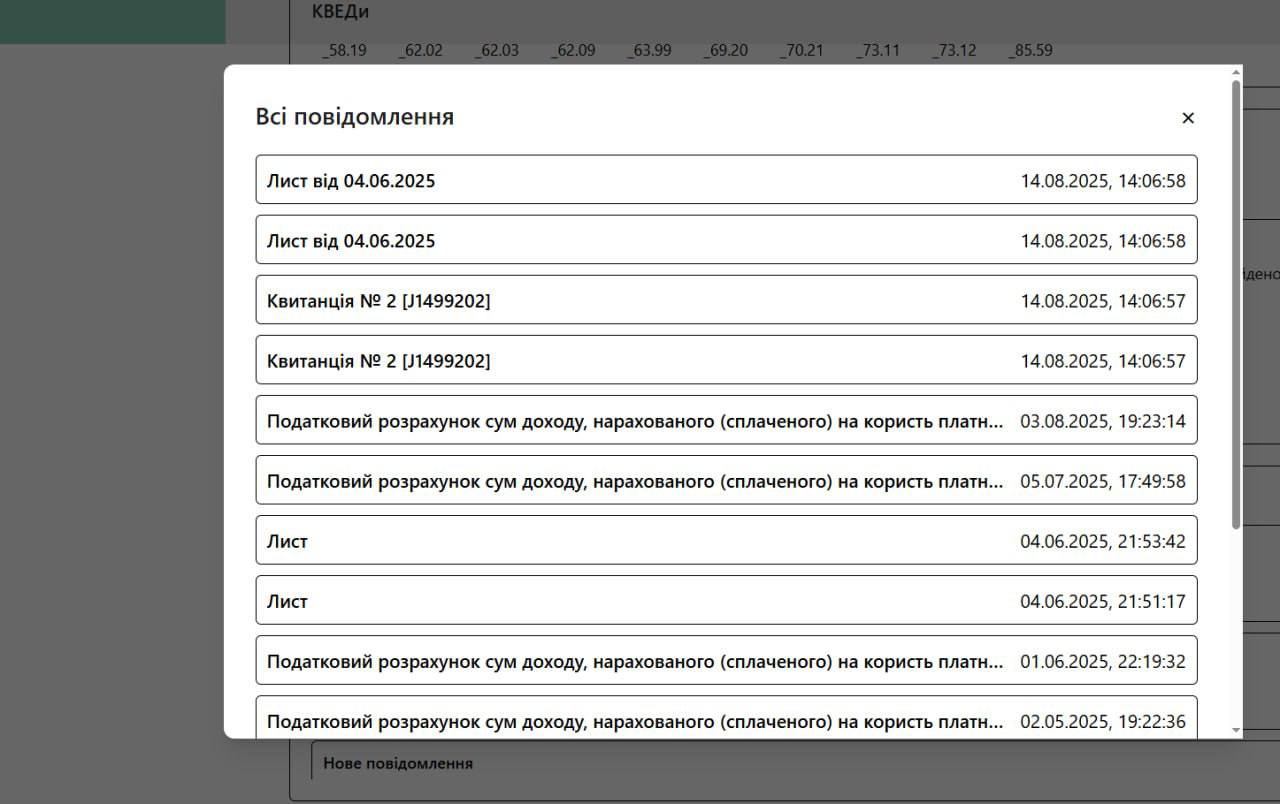

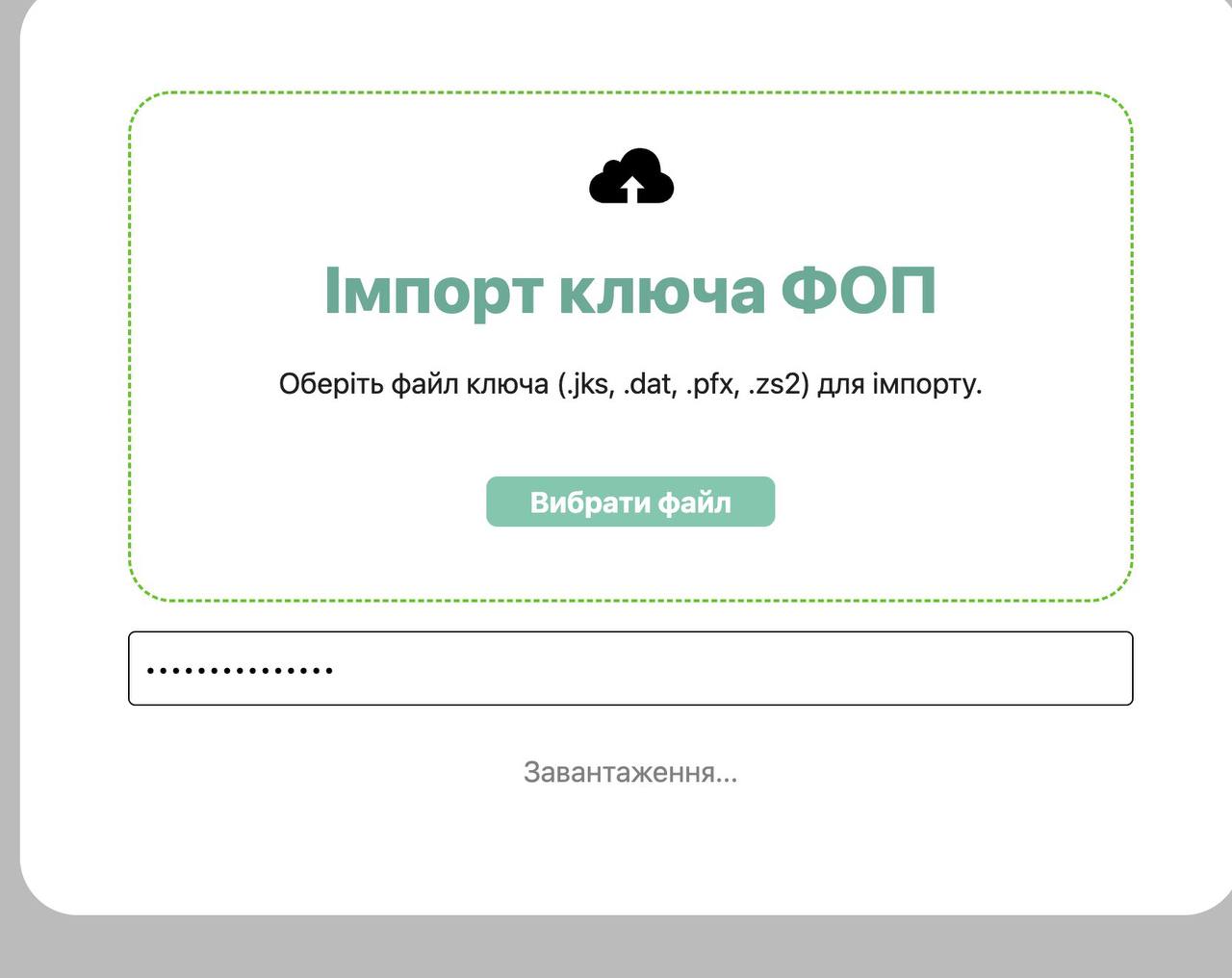

Client required a system to eliminate manual monitoring of tax cabinet for individual entrepreneurs managing multiple business entities. Primary pain points included: repetitive login procedures with cryptographic keys, manual checking for new government messages, no centralized view of tax account balances across entities, and time-consuming PDF report downloads. The solution needed to support multi-user access with role-based permissions for accountants handling multiple clients.

Implementation

Built full-stack application using Django REST Framework backend with PostgreSQL database and React TypeScript frontend. Core technical challenges included implementing PHP-based JKS cryptographic signature system for government API authentication, developing secure token encryption/decryption layer, and creating proxy endpoints to stream PDF reports without exposing authentication tokens. Backend handles automated data synchronization via scheduled tasks, pulling messages, tax account statuses, payer card information, and debt records from State Tax Service API. Implemented role-based access control allowing admin users to manage multiple entrepreneur profiles while maintaining data isolation. Frontend provides real-time notification system for new messages and tax status changes, with read/unread tracking per user. File storage layer uses Supabase for encrypted key files with signed URL generation for secure access. System architecture separates concerns: signer service handles cryptographic operations, sync modules manage data updates, and view layers provide filtered access based on user permissions.

Challenges & Solutions

Cryptographic library fragmentation: Ukrainian government e-cabinet requires DSTU 4145-2002 elliptic curve signatures — standard has no production-ready Python implementation. Native uapki library exists but designed for DAT/ZS2 formats only, lacks JKS support which 60% of clients used. Solution: Built hybrid architecture calling PHP PPOLib via subprocess for signature generation, parsing results in Python for further processing. Trade-off: Added 200-300ms latency per authentication but guaranteed compatibility across all key formats.

Multi-format key handling: Clients provided keys in 4 formats with different certificate storage conventions. JKS stores cert+key together; DAT/ZS2/PFX store separately requiring EU-*.cer files in same directory. Solution: Temporary directory isolation — copy uploaded file + scan for adjacent .cer files, pass directory path to PHP signer. Edge case handling: When .cer missing, extract subject data from signed response instead of failing.

IPN extraction inconsistency: Tax ID (IPN) location varies by Certificate Authority — newer certs use OID 1.2.804.2.1.1.1.11.1.4 extension, older certs embed in CN field or serial_number. Solution: Implemented fallback chain: (1) Try subject_directory_attributes OID, (2) Regex search CN for 10-digit pattern, (3) Search serial_number, (4) Return partial masked IPN if all fail. Production data: 78% extracted via OID, 19% via CN regex, 3% required manual verification.

Token security vs. performance: Authentication tokens must be cached (re-authentication on every API call would trigger rate limits) but storing plaintext tokens creates audit liability. Solution: Fernet symmetric encryption with environment-derived key, stored as custom EncryptedTextField. Encryption/decryption happens at model layer, transparent to view code. Performance impact: ~5ms per token operation, negligible compared to 800ms API round-trip.

PDF streaming without storage: Government reports can be 2-5MB, storing temporarily would fill disk on high-volume days. Solution: Python requests with stream=True + Django StreamingHttpResponse — bytes never hit disk, piped directly from upstream API through Django to client browser. Challenge: Debugging stream corruption required implementing request logging at byte level since errors weren't visible in normal logs.

Stale token detection: Encrypted tokens might be valid in DB but expired on government side. Solution: Implemented token_created_at timestamp + proactive refresh 7 days before expiry. On sync failure, attempt re-authentication before reporting error to user. Reduced "broken sync" support tickets by 85%.

Results & Impact

Reduced tax monitoring overhead from 2-3 hours daily to under 15 minutes. Eliminated manual key file management across multiple devices — entrepreneurs upload encrypted JKS once, system handles all subsequent authentications. Notification system decreased average response time to government messages from 48 hours to same-day, improving compliance. Multi-user access enabled accounting firms to serve 5+ clients through single interface instead of juggling separate credentials. PDF report proxy removed download/re-upload workflow, cutting document processing time by 70%. Automated sync eliminates login friction, resulting in 90% reduction in forgotten password scenarios. Role-based permissions provided audit trail for accountant actions, addressing client security concerns.

Lessons Learned

Legacy infrastructure isn't always technical debt: Initial instinct was rewriting PHP cryptography in pure Python. Would have cost 80+ hours building DSTU 4145-2002 implementation from scratch vs. 8 hours wrapping existing PHP solution. Sometimes subprocess calls beat reinventing wheels — especially for compliance-critical cryptography where bugs = security vulnerabilities.

Heterogeneous key formats are real-world constraint: Attempted convincing client to standardize on JKS-only. Banks issue what they issue; PrivatBank still ships DAT files in 2024. System flexibility to handle "the format clients actually have" was more valuable than engineering elegance of supporting one format perfectly.

Certificate parsing is messier than documentation suggests: OID standards exist but CAs don't always follow them. Production encountered certificates with IPN in CN field formatted as "ПІДПРИЄМЕЦЬ 1234567890", "ІПН:1234567890", and "1234567890 / ПІБ". Regex fallback wasn't lazy coding — it was accepting certificate issuers don't read specs carefully.

Token expiry handling prevents support burnout: First version had no proactive refresh — tokens expired silently, users reported "sync broken". Implementing token_created_at + 7-day pre-expiry refresh reduced reactive support tickets 85%. Small database field paid for itself in saved developer time within 2 weeks.

Streaming large files matters at scale: Initial implementation saved PDFs to /tmp then served them. Filled 50GB disk in 3 days during tax season. Switching to streaming eliminated storage entirely — proper solution for proxy endpoints regardless of current data volume.

Multi-user access patterns surface slowly: First 2 months, only senior accountant used system. Month 3, hired junior staff exposed permission bugs — they could see all clients' data. Role-based access wasn't premature optimization; it was essential feature that only manifested when actual multi-user scenario occurred. Build RBAC from start, don't retrofit.

Project Gallery

Visual overview of the implementation process

Ready to Start Your Project?

Let's discuss how we can bring your ideas to life with custom AI and automation solutions.